Lasting Power of Attorney

Retain control over your affairs

Unexpected changes in mental or physical health can significantly impact one’s ability to make decisions. Consequently, maintaining control over personal affairs becomes paramount. A Lasting Power of Attorney is a crucial tool to achieve this. By designating trusted individuals to manage your estate and affairs, you can confidently retain control.

What is a Lasting Power of Attorney?

The definition of a Lasting Power of Attorney (LPA) is a legal document that allows someone to make decisions for you, or act on your behalf. In the event that you are no longer able to do so yourself.

You can use an LPA at any stage of life to prepare for potential incapacity. While LPAs are often associated with the elderly, anyone over the age of 18 can create one.

An LPA empowers you to designate trusted individuals as your attorneys to make decisions on your behalf. These attorneys will manage your affairs according to your wishes. Importantly, an LPA is a separate legal document from your Will. Nonetheless, many people create both simultaneously as part of their overall estate plan.

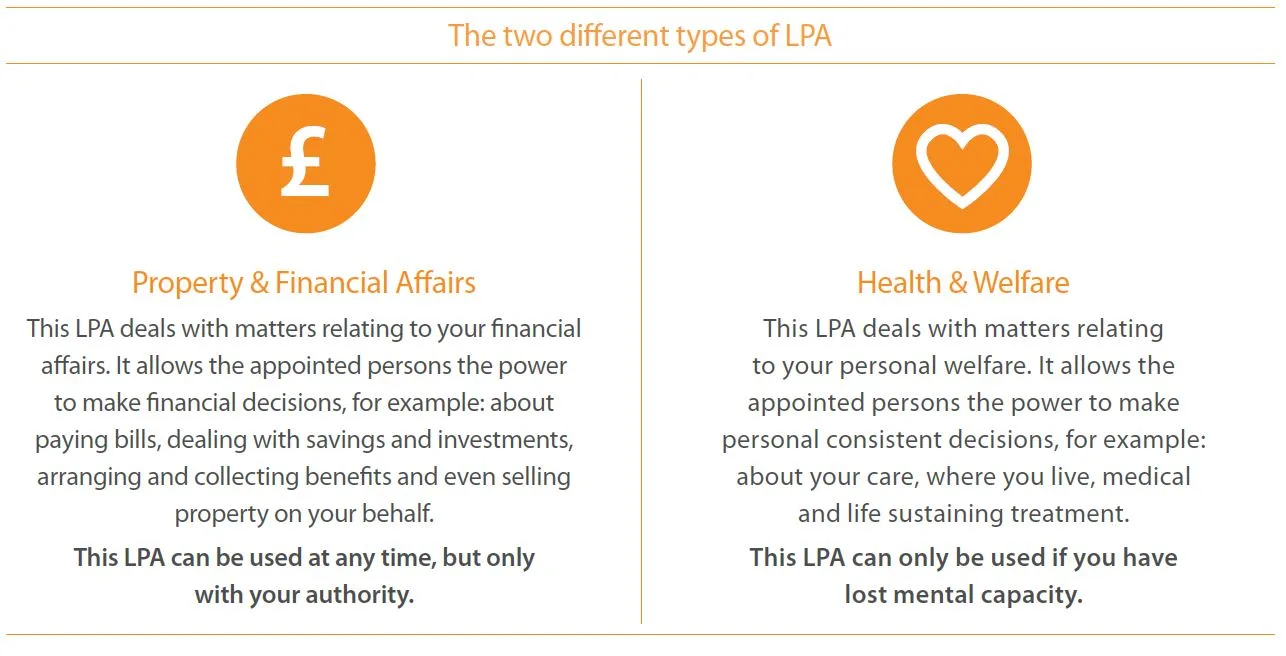

To learn about the different types of Lasting Power of Attorney and their advantages, please see below.

You can grant trusted individuals the power to act on your behalf through an LPA, but only if you lose the ability to do so yourself. In addition to selecting your attorneys, you have the option to impose restrictions, although this is uncommon. Crucially, your attorneys have a legal obligation to act solely in your best interest. To create an LPA, you must possess full mental capacity. Therefore, it is advisable to prepare one sooner rather than later as no-one can predict what the future holds.

How to make a Lasting Power of Attorney

Firstly, LPA’s are prepared and signed by all relevant parties, including you, all your attorneys and your Certificate Provider. This is the person who certifies that you understand what you are doing and that you are not being coerced. They understand that there is no reason why the LPA should not be done.

Secondly, in order to use them, LPA’s must be sent to and registered with the Office of the Public Guardian (OPG)

There is a registration fee of £82 per document and this is payable direct to the OPG.

We always recommend you register your LPA’s when you make them as this saves time and inconvenience further down the line. Once registered an LPA can be used as and when it is needed.

At EPS we offer a full Lasting Power of Attorney service. We arrange and prepare all your documentation for you, obtaining the necessary signatures from your attorneys and certificate provider. Should you choose to register your LPA’s when you make them, we can deal with the registration for you also.

For further insights, current industry news and updates on Lasting Power of Attorney...